January 22, 2019

How to Reach Technology “Late Adopters” in the Revenue Cycle

Technology brings many advantages and conveniences, not only to healthcare delivery but also to the patient experience outside of the hospital walls. The healthcare industry serves people of all ages, races, abilities, preferences, and socioeconomic statuses, so providers cannot alienate any patient from accessing healthcare communications and payment options safely and comfortably.

While our industry must focus on technology advancements to keep pace with consumer demands, we cannot lose sight of those consumers who do not appreciate, trust, or use the latest technology — consumers who do not own smartphones, who prefer phone conversations with live representatives, who trust postal mail over email, or who do not own or prefer not to use credit cards.

Who Are the Late Adopters?

When it comes to smartphones and tablets, the age range most uncomfortable with new technology is, unsurprisingly, those age 65 and older. While this demographic makes up about 15 percent of our population today, it is expected to account for 22 percent by 2050.

Although technology adoption is trending favorably among this group, their comfort level with it is not necessarily doing the same. About four in 10 older Americans own smartphones (up from 18 percent in 2013), but they continue to use traditional methods to pay their bills: 40 percent pay bills via postal mail and 31 percent use checks to pay bills.

So, how do you reach these patients who are wary of today’s conveniences? The answer, ironically, is through technology. An advanced analytics solution can help your health system identify behavioral patterns, preferences, and predicted outcomes among your patient population. You can use this intelligence to your health system’s advantage to collect more payments in full from all patient demographics and improve your cash flow.

Here are three patient touch points where you have the opportunity to tailor the conversation to these tech-cautious patients:

Print Statements

Although printed billing statements are required by law, sending the same statement to all patients is a missed opportunity for personalization. Print statements tailored to known and predicted patient preferences help you collect a higher percentage of payments and alert patients to alternative payment options.

These statements are especially important for patients who prefer to manage their healthcare communications and payments via postal mail. Remember, these are likely the same people who do not opt for paperless communications, do not want to use your online patient portal, and do not trust smartphones to manage their finances.

Print statements are critical for reaching and engaging with this population. Pay particular attention to your A/B testing for this segment, feature phone numbers prominently since this group is more likely to pay their bill over the phone, and make it obvious which number to call for which desired action.

Include clear instructions for mailing in payments, setting up payment plans, or applying for charity programs, as these are typical behaviors for this population.

Devote less statement real estate to enticing them to sign up for an online portal; you aren’t likely to convert many of these people.

Phone Support

A certain subset of patients who are uncomfortable with online payments will always want to speak with a customer service representative regarding their sensitive payment data. That’s what they are used to and how they feel most comfortable handling healthcare transactions. Embrace those people and provide easy access to customer support phone numbers to reduce their frustrations.

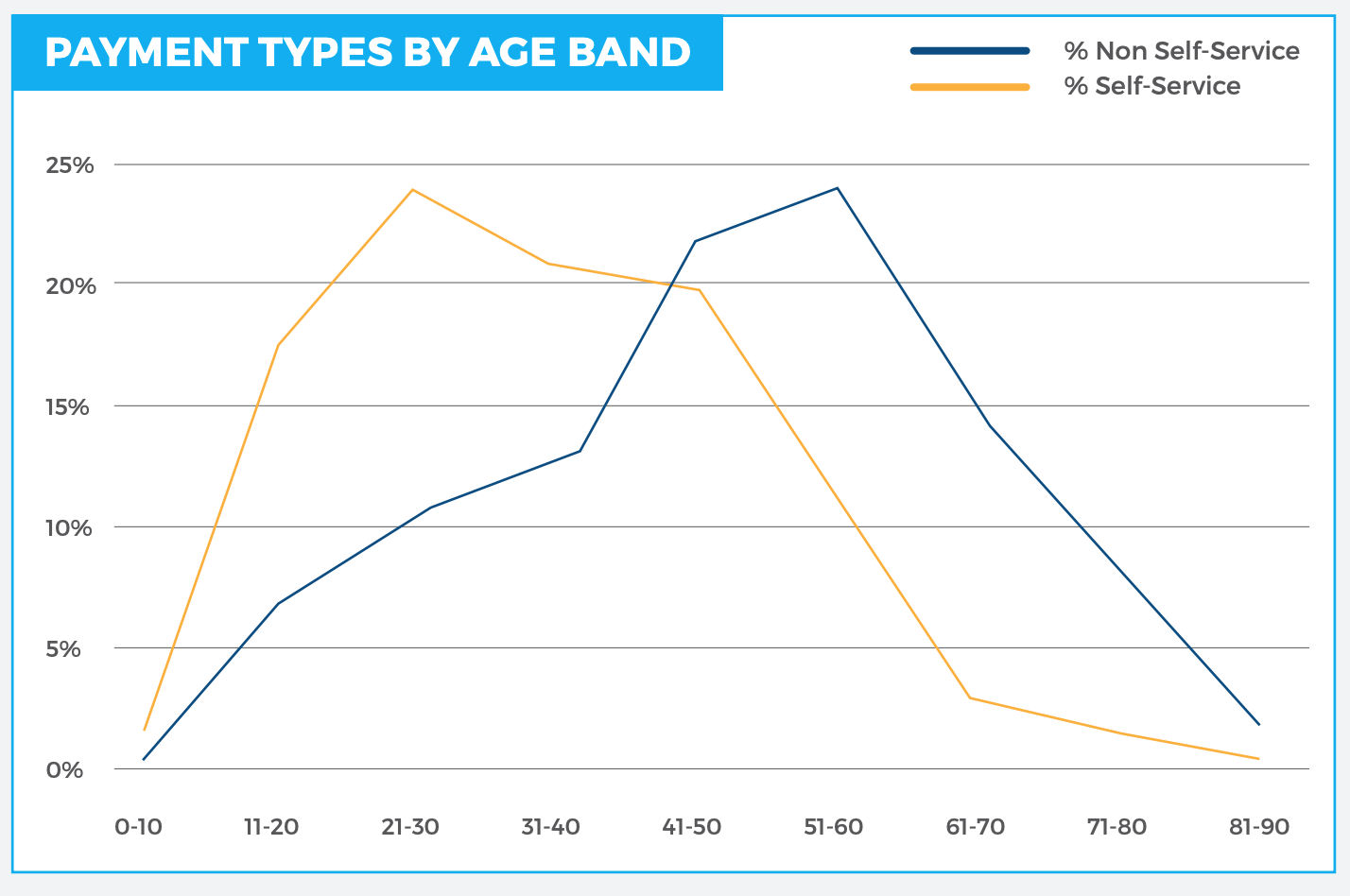

When it comes to phone support, patients ages 51 to 60 are the most likely to require assisted payments.

While it may not be possible to get these patients to make the monumental leap from live customer support to complete self-service online payments, it certainly is possible to get them to take baby steps toward self-service to improve your revenue cycle efficiency.

Inbound IVR can be a logical, unintimidating next step for these patients. Promote your IVR phone number and tout the convenience and security of your phone payment system. Also, share its ability to give accurate account information, and the option to speak with a live representative at any time.

A simple switch to IVR can reduce attended inbound calls by 15 to 30 percent — helping health systems avoid customer service bottlenecks on the busiest days of the week and month.

Payment Options

Age and technology are not the only variables to consider when analyzing your revenue cycle opportunities. Knowing your patients’ payment preferences is increasingly important to patient acquisition, retention, and bill collection. One important factor to consider here is credit card use.

Minorities are less likely to have access to a credit card, due in part to their lower confidence in getting approved. When it comes to generational differences, millennials are least likely to have a credit card, as 64 percent of them perceive credit cards as dangerous.

While credit card, debit card, and even gift card payment processing are essential to cash flow, it’s also important to efficiently handle traditional payments of cash and checks, and provide multiple options for patients to make such payments.

Seniors pay over 30 percent of healthcare bills by check, whereas millennials do so less than 10 percent of the time. On the contrary, millennials pay 40 percent of their bills by credit or debit card, compared to less than 20 percent of seniors.

Don’t Lose Sight of Traditional Channels

In an effort to streamline patient payments and communications, don’t forget about your more traditional healthcare consumers who may need extra assistance or like to do things the old fashion way.

Although you shouldn’t abandon your efforts to convert these traditional payers to more efficient payment options, don’t press too hard. Continue educating them on the safety and security of payments through a trusted online portal or the convenience of a 24/7 automated phone line. Just keep in mind their current payment preferences and continue providing exceptional service from all channels.

For more on the impact of age on self-service payments, read our white paper.

RevSpring Can Help

Integrated payment communication is part of RevSpring’s DNA. We tailor the payment conversation to influence behavior and inspire action. Our segmentation rules and workflows help you become hyper-focused on the patient, understanding their ability to pay and mapping their financial obligations to repayment pathways.

If you’d like to learn more about our comprehensive patient engagement and billing solutions, we’d love to help you. Request a demo to see how we can help your organization meet its goals.