June 25, 2019

Catch Up With 2019 Revenue Cycle Compliance

As we head into mid-year, it’s a great time to take a fresh look at what CMS (Centers for Medicare & Medicaid Services) has been up to and how regulations impact your revenue cycle department. To help you build some inertia, here are a few developments to keep an eye on and tips to get (and keep) your department caught up and compliant.

CMS Final Inpatient Payment Rule

Price transparency is a pressing goal for revenue cycle departments across the country, and CMS has the ball rolling for 2019.

They released their Inpatient Prospective Payment System (IPPS) rule at the end of last year to increase price transparency for patients and also boost payments for acute care hospitals. The final rule is available here but let’s look at a few key takeaways to keep in mind as 2019 unfolds.

Increasing Cash Flows

Acute care hospitals that are reporting quality data and are making meaningful use of EHRs should see a 1.85 percent increase in their medical operating rates in FY2019. Make sure you have checks in place to verify whether you’re missing out on revenue.

Boosting Price Transparency

The rule requires hospitals to publish standard charges online, and that has to be done in a machine-readable format and updated at least annually. By now, you should have these charges published and updates assigned to a specific role in your organization.

Reducing Documentation

The rule cuts out a few documentation requirements like mandating certification statement detail of where information can be found in the medical record. Make sure your team isn’t taking these steps unnecessarily.

Looking forward, keep an eye out for changes next year. CMS has already released the IPPS proposed rule for FY2020.

CMS Final Outpatient Payment Rule

The ambulatory side saw payment rules finalized in November 2018 with steps to give patients more affordable options. In this case, the 2019 OPPS and ASC Payment System final rule leveraged price transparency to center patients and also reduce burdens on hospitals to give them more flexibility.

The rule is intended to control increases in the volume of covered hospital outpatient services by applying a Physician Fee Schedule (PFS) with an equivalent payment rate for clinic visit services when provided at an off-campus provider-based department (PBD) paid under the OPPS. Since the clinic visit is the most common service billed under the OPPS, the impact could be significant for your organization.

There are also a few more updates: you can read more about the New Technology Payment Policy, Device Intensive Policy, and Hospital Outpatient Quality Reporting (Hospital OQR) program here.

The rule has been challenging for some organizations since the non-budget-neutral payment reduction means ‘grandfathered’ off-campus departments that were protected under section 603 language are now seeing reductions in payment.

Patient-Driven Groupings Model

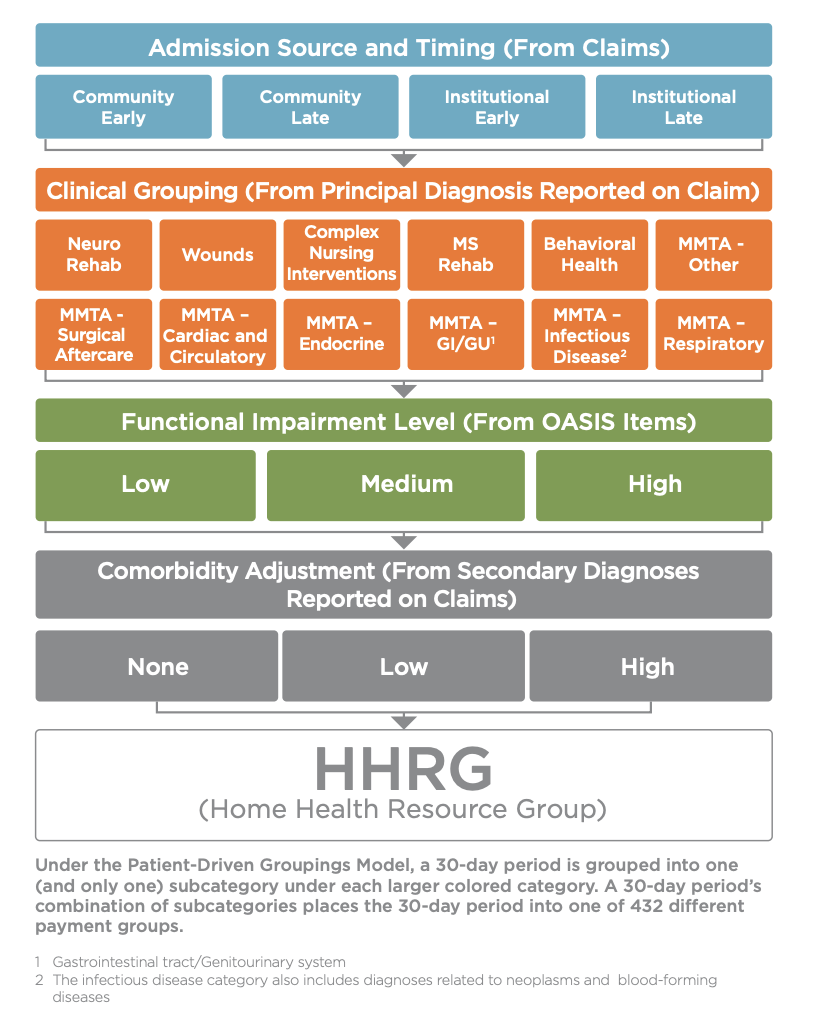

Long-term care hospitals should keep an eye out for this heading into 2020 — CMS has proposed this new payment model for implementation on January 1, 2020. Designed to eliminate therapy volume as a payment factor, the Patient-Driven Groupings Model (PDGM) creates five separate payment categories that are affected by the new approach to grouping:

- Admission Source

- Timing of the 30-Day Period

- Clinical Grouping

- Functional Level

- Comorbidity Adjustment

Most importantly, it uses 30-day periods as its payment basis (illustrated here), with periods categorized into 432 case-mix groups for payment adjustment. We’re only about half a year out, so now is a good time to start getting familiar.

Keeping up with Compliance

Compliance rewards the proactive, so here are a few tips to help you make sure none of the regulations above catch you by surprise.

Evaluate Impact

These regulations may or may not apply to you depending on the type of services you offer and your current revenue cycle practices. Review them to decide which are pertinent and how they might play out in your current revenue cycle environment. Make sure to keep an eye out for missed revenue, chances to increase cash flows, denials risks, as well as opportunities to simplify workflows and free up employee time where possible.

Educate Your Team

It will be important that you identify the roles and titles of who in your organization will deal with the brunt of the change and make sure they understand the regulations in relation to their individual responsibilities. Most regulations have a multi-faceted impact on a hospital revenue cycle, so keeping your people informed and up to date might take a multi-pronged approach to training and awareness.

Leverage Technology

According to Becker’s, leading hospitals are getting in front of the new transparency regulations by investing in tools that provide their patients with reliable out-of-pocket estimates. As CMS digs deeper into supporting patient-centered initiatives, technology that centers their experience will become vital.

While you’re evaluating that technology and establishing your strategy, make sure to look for a partner that understands strategic patient communications, as well as the potential that analytics holds in driving optimal outcomes.

RevSpring Can Help

Integrated payment communication is part of RevSpring’s DNA. We tailor the payment conversation to influence behavior and inspire action. Our segmentation rules and workflows help you become hyper-focused on the patient, understanding their ability to pay, and mapping their financial obligations to repayment pathways.

If you’d like to learn more about our comprehensive patient engagement and billing solutions, we’d love to help you. Request a demo to see how we can help your organization meet its goals.