July 19, 2019

What Happens When Financial Toxicity Goes Mainstream?

Since we started discussing financial toxicity, there have been signs that the public is becoming more aware of the concept.

Earlier this year, the New York Times published an article titled The Financial Toxicity of Illness that highlights what many of us already know — for cancer patients, even young ones, treatment can mean financial trouble, which can impact outcomes. If you read the comments, you’ll see the public asking questions about general costs of healthcare and what financial toxicity looks like for other diseases.

The lesson: patients are paying attention to financial toxicity, and they’re looking for support.

This means that revenue cycle leaders need to be prepared, but also that they have an opportunity to position themselves as allies to their patients in combating financial toxicity. It all starts with breaking down the silos that contribute to your patients’ financial challenges.

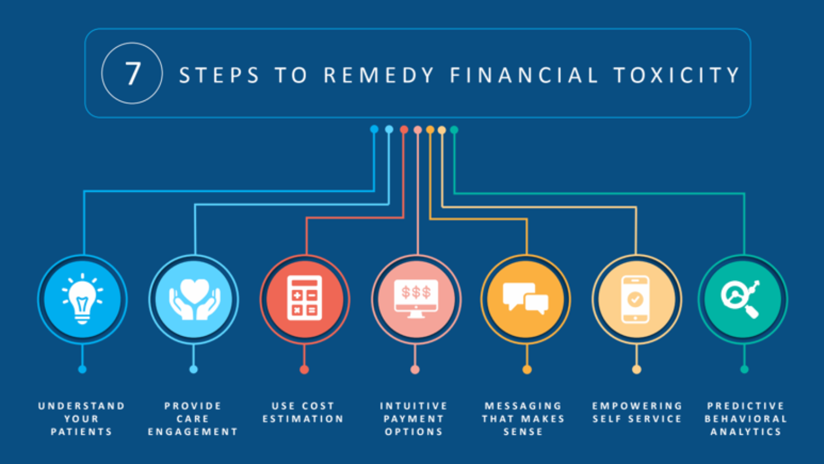

The 7 Steps Become Even More Important

In earlier years, revenue cycle professionals could have simply and quietly moved forward in addressing financial toxicity. But since patient expectations around engagement are changing (thanks to the consumerization of healthcare), you’ll need to take direct action.

We’ve covered the 7 steps to remedy financial toxicity before, and in the age of consumerization and public awareness, they take on a new role.

1. Understand Your Patients’ Feelings about Financial Toxicity

This principle is at the root of healthcare consumerization, but in an environment where patients are concerned about the impact of financial toxicity, it takes on new weight.

Make sure you understand more than just your patients’ financial profiles, but also their attitudes around money and financial stress. This will help lay a foundation that addresses financial toxicity from the start.

2. Be Proactive About Care Engagement

Patients who are aware of financial toxicity will expect you as a provider to be driving engagement. You will need to make extra effort to break through the isolation and intimidation that can arise because of financial strain. This will involve helping them navigate their bills as comfortably as possible with simple, personalized communication.

3. Use Cost Estimation

Never underestimate the power of cost estimation — especially when financial toxicity is overtly on the table.

Providing up-front service estimates can do a huge amount of the heavy lifting in easing patient stress about upcoming financial obligations, taking some of the fear out of the unknown during difficult times. This is especially true as awareness of the role hospitals sometimes play in exacerbating the impact of medical debt becomes a more commonly discussed topic.

4. Provide Intuitive Payment Options That Empower

Patients shouldn’t have to strain to pay you. Your patients should be empowered through flexible and intuitive payment options that allow them to pay in the ways they find most comfortable.

Offering payment options like credit and debit cards, cash, mailing in checks, phone payments, POS payments, and even flexible payment plans are strong indicators that you’re making an effort to help patients beat financial toxicity before it starts.

5. Use Messaging That Makes Sense

Empathy has always mattered, but patients who are aware of the impact of financial toxicity will give you even more credit for proactive messaging that centers on their needs.

You have an opportunity to leverage every email, text, and billing statement as personalized and high-visibility outreach in the battle against financial toxicity.

6. Empower Self-Service

One of the core issues behind financial toxicity is hospitals and health systems holding the payment reigns a little too tightly. Self-service options like website payments, phone payments, and paying via text are proof that you’re willing to let go and allow your patients to pay 24/7/365.

7. Predict Behaviors Around Financial Toxicity

Public awareness of financial toxicity is in flux, so it’s worth keeping an eye out for potential changes in your patient behavior as awareness increases. Continue to listen and adjust so you can continually demonstrate your position as a partner in tackling financial toxicity.

Keep Monitoring Financial Toxicity

At RevSpring, we’re maintaining our focus on financial toxicity, and you should do the same. Keep listening to the voice of the patient through surveys and personalized communications, so the public perception of financial toxicity doesn’t catch you off guard.

RevSpring Can Help

Integrated payment communication is part of RevSpring’s DNA. We tailor the payment conversation to influence behavior and inspire action. Our segmentation rules and workflows help you become hyper-focused on the patient, understanding their ability to pay and mapping their financial obligations to repayment pathways.

If you’d like to learn more about our comprehensive patient engagement and billing solutions, we’d love to help you. Request a demo to see how we can help your organization meet its goals.