June 11, 2019

Is Financial Toxicity Infiltrating Your Health System?

You’ve heard about financial toxicity and what it means for your patients — crippling debt, stress-related health issues, and distrust of the healthcare system — but have you put any plans into action to ease the stress for your patients? Do you know how a negative patient financial experience can impact your organization’s fiscal health? It’s time to be proactive about financial toxicity.

Healthcare leaders cannot be passive when it comes to the health of their patients. Granted an issue as complex and widespread as rising out-of-pocket healthcare costs cannot be solved by a single CFO in one health system, there are things individual organizations can do to lessen the real dangers of financial toxicity.

Your primary goal as a financial leader should be to do no harm to the patient from the financial side. Complex and confusing billing statements and payment processes can add stress to an already difficult time in a patient’s life — stress that has the power to derail and counteract the positive effects of medical treatments.

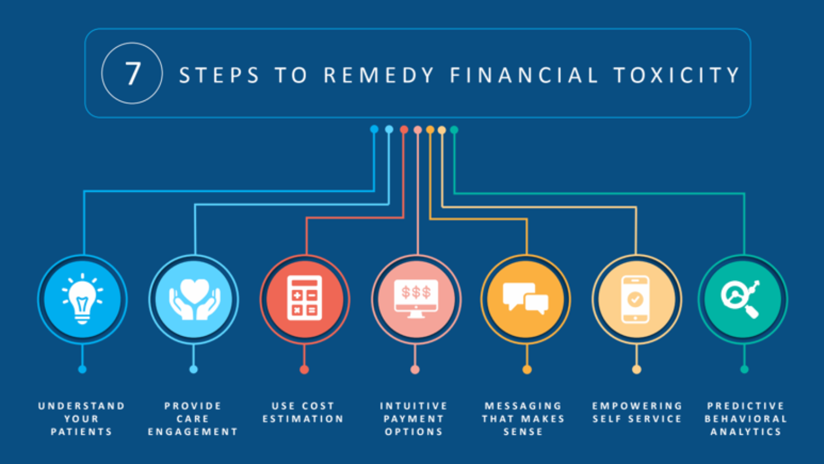

Receiving and paying for a medical bill will never be fun for a patient or family, but it should be simple and clear. And it should never detract from the patient experience. Here are seven ways your organization can alleviate the effects of financial toxicity to keep your patients happy and your organization healthy.

7 Steps to Remedy Financial Toxicity

1. Understand Your Patients

While revenue cycle leaders don’t have the authority to alleviate the financial burden completely, they can and should take every opportunity to make the process more empathetic, intuitive, and positive for the individual patient.

Extend your person-centered care values from the clinical side to the financial side to make your patients feel cared for, valued, and respected. Just as every person’s healthcare needs are unique, so are their financial situations. When you make an effort to understand your patients as individuals with families, careers, and obligations, you can approach them about finances in ways that make sense to them.

2. Provide Care Engagement

Financial toxicity can cause patients to disengage from their healthcare team and their loved ones. Going through a medical episode can be isolating and intimidating. The revenue cycle department can serve as an advocate, helping patients keep up with appointments and stay ahead of their bills with simplified, personal communications.

3. Use Cost Estimation

“What will this cost me?” It’s a simple question, yet one that 90 percent of hospitals cannot answer for their patients.

Up-front service estimates are perhaps the best way to ease a patient’s stress about a pending financial obligation. Take the fear of the unknown out of the financial equation and help patients set up a plan of action so they don’t feel the unnecessary burden of unexpected medical debts piled on top of an already stressful and uncertain experience.

4. Provide Intuitive Payment Options

Remove barriers to payment so you can collect on a higher percentage of your invoices. Empower patients to pay their bills on their terms by giving flexible, intuitive payment options. Allow your patients to pay by credit card, debit card, cash, or check via mail, over the phone, at the point of service, or over time with a flexible payment plan. Add choices to break down barriers.

5. Use Messaging That Makes Sense

The power of empathy should be on full display in every billing statement, email, text message, or other communication you send to your patients. All communications should be personalized to fit each individual’s needs, making it clear what you are asking of them and why, along with direct steps to complete the action.

6. Empower Self-Service

Some patients feel comfortable making payments themselves through unassisted technology such as websites, phone calls, and text messages. Be available for these patients 24/7/365 with always-on technology to capture payments and answer questions. You never know when your patients will be ready to engage, so be prepared at all times.

7. Predict Behaviors

No matter how well you think you know your patients, one thing is for sure: they are continually changing. Keep up with their new habits and preferences so you can continue to serve them with personalized communications and tailored payment options for years to come.

Stop the Spread of Financial Toxicity

Financial toxicity first and foremost affects your patients; but in time, it will trickle through your revenue cycle to harm your organization’s bottom line if not proactively prevented. Ensure financial toxicity doesn’t infiltrate your organization by helping your patients feel empowered and understood in their healthcare journey. Continue to look for opportunities to ease the stress for your patients both within the clinical encounter and outside it.

RevSpring Can Help

Integrated payment communication is part of RevSpring’s DNA. We tailor the payment conversation to influence behavior and inspire action. Our segmentation rules and workflows help you become hyper-focused on the patient, understanding their ability to pay and mapping their financial obligations to repayment pathways.

If you’d like to learn more about our comprehensive patient engagement and billing solutions, we’d love to help you. Request a demo to see how we can help your organization meet its goals.