February 12, 2019

Reinventing the Revenue Cycle in 2019 With a Consumer-Focused Mentality

Most revenue cycle processes and procedures were put in place to serve insurance payers, but with growing self-pay responsibilities, today’s patients are assuming the role of the savvy consumer in their own healthcare experience. Unfortunately, many hospitals aren’t equipped to handle this shifting payment dynamic.

Consumers in any industry tend to remember most vividly their first and last interactions with a company. In the case of healthcare, those critical interactions are typically an appointment scheduling, a reminder communication, or a financial statement.

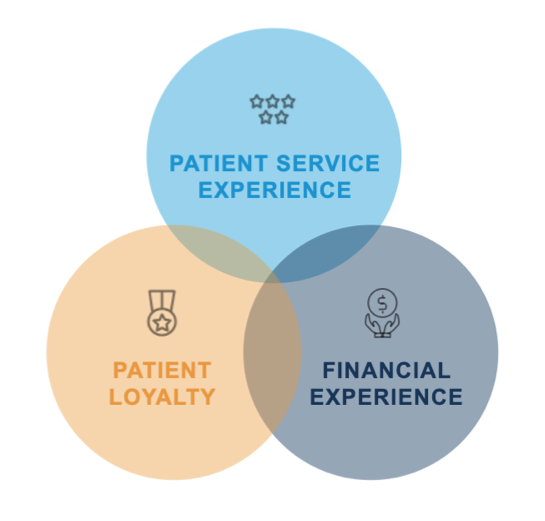

The overall patient experience extends well beyond the clinical encounter. In fact, revenue cycle has far more patient touchpoints than the clinical side — uniquely positioning the revenue cycle to bookend the clinical encounter and leave a lasting impression of the overall healthcare experience.

Patient Challenges At The Forefront of Revenue Cycle Strategy

Financial struggles are a barrier to receiving and paying for medical services for many Americans. Twenty percent of working families with health insurance struggle to pay medical bills, and 50 percent of uninsured individuals cannot afford to pay for healthcare services received, according to the Kaiser Family Foundation.

The Federal Reserve found that 40 percent of Americans couldn’t cover an unexpected $400 expense. This means many patients are hard pressed to cover the average balance after insurance of $300 or the average uninsured bill of $1,100.

To make matters worse, many patients struggle to comprehend complex medical statements, making it less likely that they will know what they owe, which services they are paying for, and how to pay.

Patient Engagement Opportunities

Run a Communications Audit

Unclear communication is often a barrier to patients understanding their options and making them feel truly empowered in their healthcare experience.

When is the last time you did an audit of your patient communications? Take a look at every patient communication in your automated campaigns and ask yourself, “Could this be more clear?” “Could I provide more options?”

Put yourself in your patients’ shoes and clarify any barriers to understanding. This includes any automated phone messages, texts, emails, and portal messages.

Redesign Billing Statements

Statement design should be in a constant state of testing. There is no such thing as the “perfect statement.” Tinker with your statement designs and run A/B tests to improve patient satisfaction, bill comprehension, and understanding of payment options.

A financial statement is likely the first post-discharge patient touch point and is your opportunity to leave a good impression. As consumers become more data savvy, they are willing to travel to further health systems for better care or lower costs. Patient loyalty is a goal you should be tracking and one in which the revenue cycle is playing an increasingly important role.

Utilize Data Analytics

Predictive scoring is the most underutilized asset in revenue cycle management. With the data you already have in your HIS, you can predict patients’ payment behaviors, if they qualify for financial assistance, and which communication channels they prefer, helping you route patients to the appropriate internal workflows.

Take your tracking a step further by analyzing the channels that are most effective and what percent of payments are made after the first statement, past-due notice, or final notice. Use data to get a better understanding of your revenue cycle, optimize workflows, and smooth out the inefficiencies. Your systems already hold the data; you just need to get it in the right hands.

Powerful technology that can drive these revenue cycle efficiencies is not out of reach for small hospitals, nor is it too cumbersome to implement in large health systems with complex HIS environments. There are concrete steps any healthcare organization can take to get started with revenue cycle improvement. You can fine-tune everything over time — the most important thing to do is start.

For more insights, view the on-demand webinar, “Reinventing Revenue Cycle Management.”

RevSpring Can Help

Integrated payment communication is part of RevSpring’s DNA. We tailor the payment conversation to influence behavior and inspire action. Our segmentation rules and workflows help you become hyper-focused on the patient, understanding their ability to pay and mapping their financial obligations to repayment pathways.

If you’d like to learn more about our comprehensive patient engagement and billing solutions, we’d love to help you. Request a demo to see how we can help your organization meet its goals.