January 29, 2019

Recurring Payments in Healthcare: How to Capitalize on the Trend

Recurring payments are on the rise in most consumer verticals, healthcare included. In fact, recurring transactions processed on credit and debit cards in the U.S. are expected to reach $473 billion by 2021, according to research from the Mercator Advisory Group.

And this makes sense. Just look at the boom in subscription-based products and services. You can get everything from clothing and makeup to dog treats and toys to fresh food delivered to your door on a consistent schedule – no shopping required. You just enter your payment information once and wait while your postal service worker does all the heavy lifting.

It’s the same story with utilities, Netflix, and loans – set it once and forget about the hassles of making a monthly, timely payment.

Consumers love the convenience of setting up recurring payment plans, which limit mailed bills and put an end to remembering account passwords. As an added benefit, storing payment information on their favorite websites allows for fast checkout without entering tedious card data.

On the other end, merchants love recurring transactions, too. Businesses appreciate the consistent cash flow and the inherent loyalty established via recurring or subscription payments.

Recurring Payments in Healthcare

While healthcare doesn’t follow the popular subscription model, patients and providers can benefit from recurring payments. There are two types applicable to healthcare:

Installment Plans

Most similar to a payment plan for things like cable or a cell phone, health systems can help ease patients’ financial stress by breaking a healthcare payment into fixed installments and collecting against the total balance at regular, pre-defined intervals.

By getting patients to commit to making an initial, smaller payment, you will increase the likelihood of collecting in full. This is especially effective for larger medical bills, where the option for smaller payments increases the propensity-to-pay.

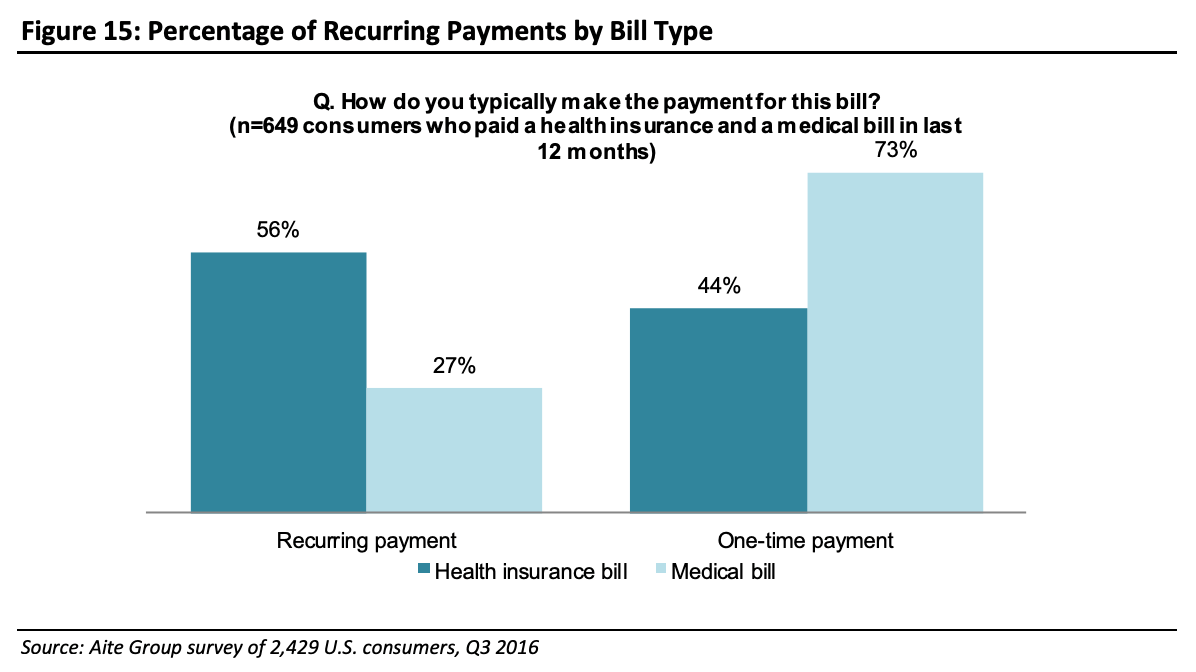

In healthcare, recurring payments are more common for health insurance premiums paid to payers (56 percent) than for medical bills paid to providers (27 percent), as indicated by research from the Aite Group.

(graphic source: here)

Payment Information Saved on File

Similar to e-commerce transactions like Amazon’s one-click checkout, providers can store patients’ credit, debit, or ACH information on file to use for future charges.

Analysis of How Americans Pay Their Bills sheds some light on how healthcare consumers are choosing to pay their medical expenses:

- Thirty-three percent of all one-time medical bill payments were made via the postal mail, with 80 percent of those payments in the form of checks.

- Another 25 percent of one-time medical payments were made on the biller’s website, though the payment methods were much more evenly distributed, leaning in favor of credit and debit cards.

These statistics reveal an opportunity to promote the ease and convenience of online payments and recurring payments. Patients using checks and mail to pay their bills will take more persuasion to switch both their payment channel and method. However, those 25 percent of patients already paying bills through the biller’s website can more easily be convinced to save their payment information for future use.

Among patients who make recurring medical payments, 71.5 percent use ACH, 18.2 percent use credit cards, and 10.2 percent use debit or prepaid debit cards.

Any recurring payment option, when offered to patients in various forms, can help to streamline checkouts, reduce the likelihood of bad debt, reduce time to collect, and improve administrative efficiency. Take a second look at how you are promoting your recurring payment capabilities to your patients in your statements and portals.

RevSpring Can Help

Integrated payment communication is part of RevSpring’s DNA. We tailor the payment conversation to influence behavior and inspire action. Our segmentation rules and workflows help you become hyper-focused on the patient, understanding their ability to pay and mapping their financial obligations to repayment pathways.

If you’d like to learn more about our comprehensive patient engagement and billing solutions, we’d love to help you. Request a demo to see how we can help your organization meet its goals.