August 29, 2018

EHR Customization: Where Does Your EHR Fall in the Ranking?

EHR giants are facing competition from smaller, more nimble players and that’s partly due to one, critical feature — customization.

As healthcare’s data challenges become more complex and expectations from patients, government agencies, and users increase, customization becomes an increasingly important consideration. To combat rising pressure from more agile offerings, major players like Epic, Cerner (Soarian), and MEDITECH are moving forward, leaving hospitals and health systems with even more complex buying options. If an older version of your current EHR is holding your team back, you might be wondering how the leading vendors stack up against each other.

Let’s take a look at how these three industry leaders are handling their customers’ complex needs through the lens of the Black Book 2017 Midyear User Satisfaction Survey of hospital and physician health systems.

Let’s take a look at how these three industry leaders are handling their customers’ complex needs through the lens of the Black Book 2017 Midyear User Satisfaction Survey of hospital and physician health systems.

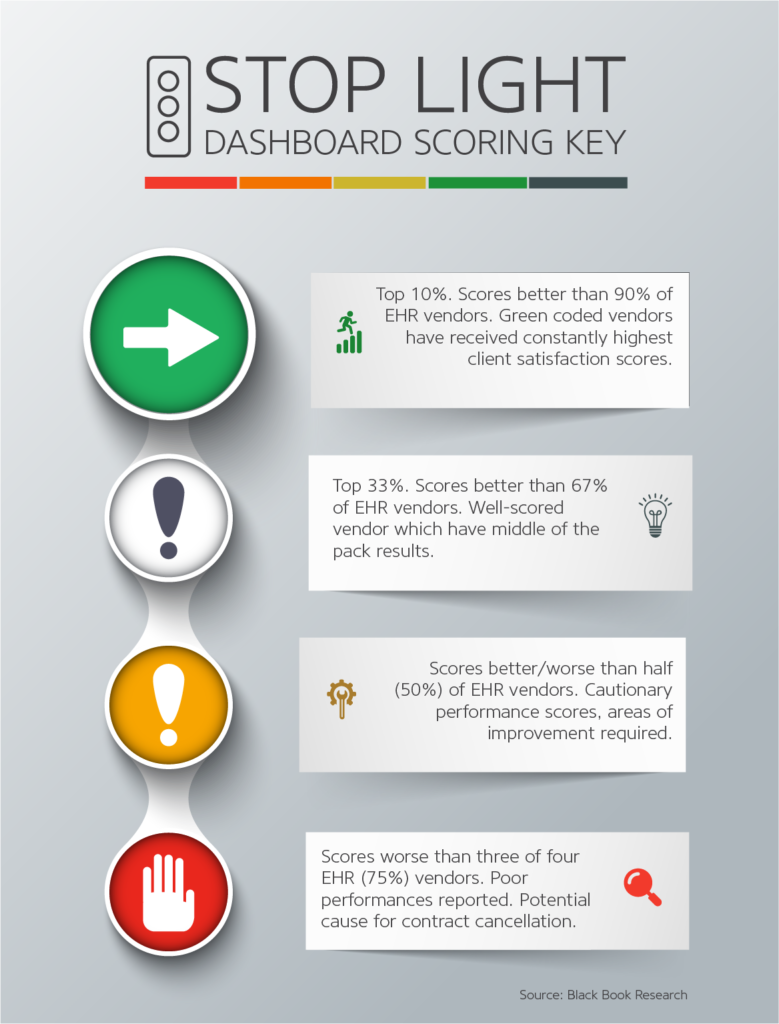

Black Book uses their “Stop Light Scoring” system to rank vendors, with scoring broken down as follows:

Green: Top 10 percent (over 8.71) – Overwhelming satisfaction, exceeds expectations, highly recommended vendor

White: Top 33 percent (7.33 to 8.70) – Satisfactory performance, meets expectations, recommended vendor

Yellow: Better or worse than half (5.80 to 7.32) – Neutral, meets or doesn’t meet expectations consistently, would not likely recommend vendor

Red: Bottom 75 percent (less than 5.79) – Deal-breaking dissatisfaction, does not meet expectations, cannot recommend vendor

Customization

Performance measures differ not just between providers, but over time. Because of this, a considerable amount of both provider and vendor effort goes into converting your needs into customizable EHR features that directly address your workflow challenges.

Black Book rates multiple systems in this category and of the three platforms we’re comparing here, MEDITECH comes out on top, ranking green and over nine points for both hospitals between 250 and 350 beds, and hospitals in the $200 and $350 million revenue range. Cerner ranked about one full point below, coming in white in both categories. At the same time, Epic fell behind Cerner for the 250–300 bed hospitals and only slightly behind in the $200M–$350M revenue category.

It’s worth noting that, Allscripts aside, MEDITECH was the only one of the three vendors to earn a green light under Black Book’s scoring system. Epic consistently ranked as the weakest in customization.

Scalability, Client Adaptability, and Pricing Flexibility

Customization doesn’t exist in a vacuum. Other factors can greatly impact the customization experience, such as flexible pricing that aligns with the exact services and functionality an organization needs.

MEDITECH stole the show in this category, ranking above a nine for hospitals between 250 and 350 beds and in the $200–$350 million range. Cerner came in relatively close in both hospital demographic categories, while Epic performed especially poorly, scoring below six points and well into the yellow and red ranges in each. On a side note, MEDITECH squarely beat out even Allscripts in this category, with both falling in the “overwhelming satisfaction” category.

Viability and Managerial Stability

The ability to make changes and enhancements doesn’t mean much if a vendor has high employee turnover, financial instability, or a cultural mismatch that hampers the enhancement process in the first place. This is one area where Epic stood out, ranking in the nines and leaving MEDITECH trailing as the weakest contender in each demographic.

Improving Your Own EHR Workflows

The main takeaway from this comparison is that every vendor has its strengths and weaknesses. The criteria used to select your optimal EHR vendor might leave you navigating a system that’s difficult to customize and a drain on your internal resources. If you find yourself in this situation, it’s time to consider partnering with a vendor who understands your HCIS workflows and wants to see you get the most out of your investment.

RevSpring Can Help

We know healthcare, and that’s why we put data to work for you and your staff. RevSpring is a leader in payment systems that maximize revenue opportunities in acute and ambulatory settings. Our at-a-glance dashboards help hospitals and health systems quickly find and close workflow gaps that are costing time, resources, and hard dollars. Since 1981, RevSpring has built the industry’s most comprehensive and impactful suite of patient engagement, communications, and payment pathways backed by behavior analysis, propensity-to-pay scoring, intelligent design, and user experience best practices.

If you’d like to learn more about our comprehensive patient engagement and billing solutions, we’d love to help you. Request a demo to see how we can help your organization meet its goals.