April 9, 2019

Budget Better: How to Use Your Data as a Cost-Saving Tool

You’ve heard a lot about the value of data in revenue cycle and you know that patient payment data helps your organization know when to reach out to patients with financial communications, how to contact patients, what payment options are right for them, and so much more.

But as with anything so valuable, data comes at a cost.

It can be tempting to delay data improvements and stick to the status quo of paper-based billing but just how much is that delay costing your organization? If you haven’t considered patient payment intelligence tools lately, it may be time for a second look.

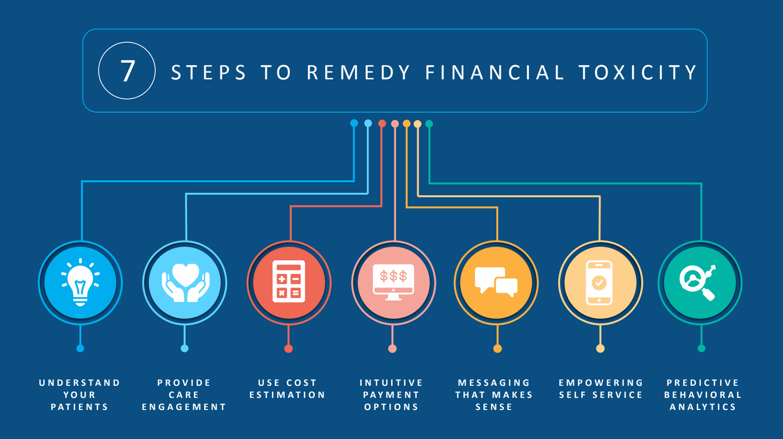

Are You Contributing to Systemic Financial Toxicity?

Nearly 40 percent of people surveyed by the West Health Institute said that paying for healthcare is more frightening than the illness itself.

Bills sent to patients can contribute to financial toxicity when they are:

- Unexpected

- Confusing

- Higher than expected

- Unclear

Personalizing the patient payment experience is key to getting better financial results for your organization and reducing the stress that medical financial burdens can put on the self-payer, which makes an investment in intelligent tools a win-win for you and your patients.

Using Patient Data From the Past to Predict the Future

Understanding your patients’ financial situations and predicting their payment abilities will help your organization deliver the tools your patients need to manage their healthcare expenses effectively. Consider these two areas as the starting blocks to implementing patient data intelligence.

Predictive Analytics and Scoring

A 75-year-old retiree on a fixed income will have different healthcare communication and payment preferences than a 36-year-old mother of two, who will, in turn, have different preferences than a 21-year-old college student.

An intelligent analytics tool will help your health system identify your patients’ payment abilities and preferences by applying advanced demographic and behavioral modeling so you can tailor your communication channels, messages, and payment options to inspire action from each individual.

An advanced analytics platform will allow your organization to perform:

- Propensity-to-pay scoring

- Financial assistance screening

- Revenue cycle business intelligence

- Communication preference prediction

Business intelligence and scoring on the front end can reduce bad debt by identifying patients who may qualify for financial assistance.

Tools like these have helped health systems reduce the days from statement to payment by 30%, reduce cost-to-collect by 88%, minimize time-to-cash, and reduce staffing requirements.

Self-Service Payment Options

Patients like to feel a sense of control in their healthcare decision-making, which extends beyond clinical encounters to their financial decisions as well.

Self-service payment options not only fulfill your patients’ desires for 24/7 access to managed healthcare but also help your organization focus staffing on high-priority issues and improve cash flow.

An online payment portal is a start to empowering patients with self-serve payment options but isn’t the end game. Today’s patients have diverse payment and technology preferences and should be able to settle their balances online, over the phone, or via text message.

Costs vs. Benefits: Real-World Revenue Cycle Improvements

Yes, there are up-front costs associated with implementing data intelligence and self-service payment options, which will cost more than sending status quo paper bills — but these revenue cycle enhancements will pay dividends in the long run in the form of more payments, timely payments, and satisfied patients who appreciate the added convenience and clarity.

Less than one year after implementing similar data intelligence and payment technologies, OhioHealth, a not-for-profit health system serving central Ohio, experienced a $7.9 million lift in payments, including a higher payment rate through self-service options and an increase in payments made in-full by patients.

To learn more about OhioHealth’s revenue cycle improvements, read the case study.

The Choice is Yours: Keep Sending Paper Bills Only or Meet Your Patients in the 21st Century?

If you’d like to see what intelligent billing technology can do for your organization, schedule a demo today.

RevSpring Can Help

Integrated payment communication is part of RevSpring’s DNA. We tailor the payment conversation to influence behavior and inspire action. Our segmentation rules and workflows help you become hyper-focused on the patient, understanding their ability to pay and mapping their financial obligations to repayment pathways.

If you’d like to learn more about our comprehensive patient engagement and billing solutions, we’d love to help you. Request a demo to see how we can help your organization meet its goals.