March 26, 2019

Struggling to Reach Generation X Patients? Follow These Communication Tips.

With so much talk about millennials and baby boomers shaping the healthcare patient journey, we often neglect the generation sandwiched in the middle: Generation X.

Gen X makes up a significant portion of the American population, about 15 to 20 percent today, and holds some interesting views and habits about healthcare and finances. As today’s Gen Xers are in the 34 to 54 age range depending on the definition, they are reaching the age of increased age-related healthcare needs and are responsible for the healthcare decisions of their children, and in some cases, their aging parents.

Between the dotcom bubble burst of 2000–2001 and the Great Recession of 2007–2008, Generation X has seen their earnings power and savings compromised, which is reflected in their financial beliefs and habits. However, the expected transfer of wealth — to the tune of around $30 trillion — from baby boomers to their Gen X children over the next 30 years will have a significant impact on Gen Xers’ finances.

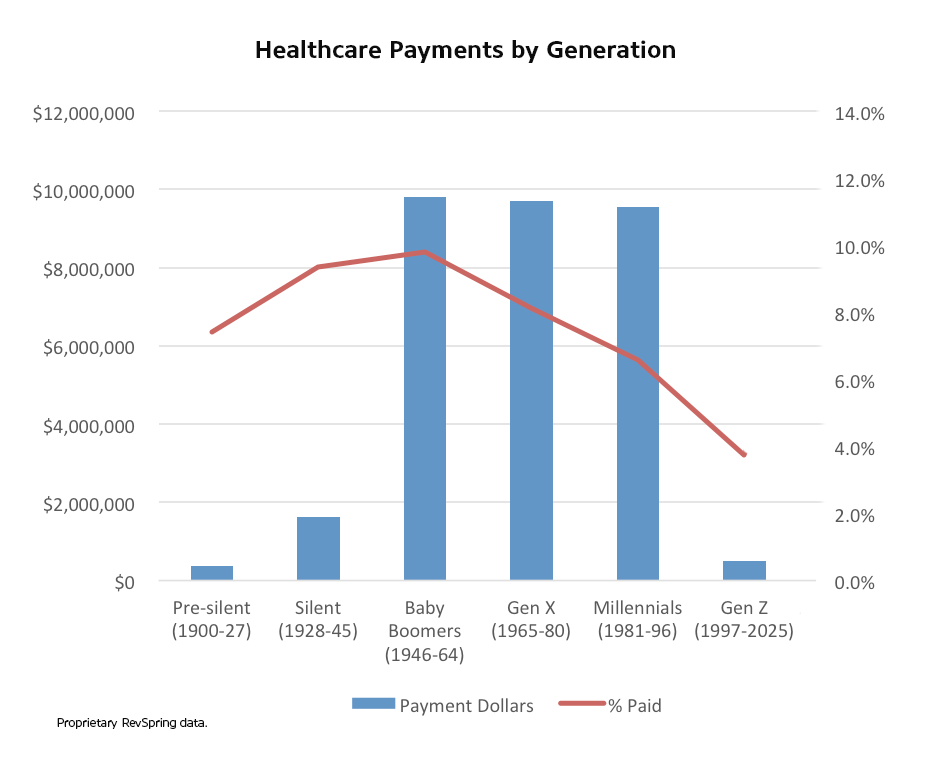

Healthcare Payment Trends Among Generation X

Gen Xers are generally tech savvy and seek the help of technology to manage and monitor their finances. Consider these statistics on Generation X as it relates to their technology and payment habits:

- Just 23 percent save money each month and feel confident in their financial futures

- 58 percent say they are in debt

- 34 percent have high-deductible health plans (trailing only millennials at 40 percent)

- 85 percent with high-deductible health plans participate in a health savings account

- 80 percent own smartphones

- Nearly 50 percent take advantage of mobile payment options

- Only 42 percent pay their credit card balance on time compared to 54 percent of millennials and 53 percent of baby boomers

Tips for Effective Healthcare Communication With Generation X

Tips for Effective Healthcare Communication With Generation X

Knowing how to communicate with patients who belong to Generation X requires an understanding of their generational preferences and views on technology. Use these tips and insights to guide your revenue cycle and patient engagement strategy:

Ease Their Fears and Skepticism

Generation X has a general distrust of authority, which extends to insurance companies, pharma companies, and even hospitals and health systems. As naturally skeptical healthcare consumers, they need open, consistent, and convenient communication from their healthcare providers — and they aren’t afraid to switch providers if their experience isn’t up to par.

Between one-third and one-half of Gen Xers surveyed by West Health Institute went without needed healthcare due to cost. Eighty percent of those surveyed had health insurance, so being insured does not preclude someone from skipping out on healthcare.

Despite their skepticism, Gen Xers are more brand loyal than any other generation, giving healthcare providers who take the time to understand and connect with these patients a unique opportunity to provide an exceptional patient experience and earn patient retention.

Encourage Low-Cost Payment Plans for Those Who Need Them

While credit card use is widespread among Generation X with 79 percent owning at least one credit card, this cohort is the worst when it comes to paying off monthly balances. Twelve percent only pay the minimum balance each month, more than any other generation.

Based on these insights, Generation X may not be likely to pay balances in full upfront. However, they are excellent targets for setting up payment installment plans. Use this generalization as part of a larger business intelligence effort to tailor payment options and patient communications based on individual propensity-to-pay scores.

Offer All Payment Options From Cash to Text Message

Thirty-three percent of Gen Xers use mobile payment options, trailing only millennials at 39 percent. The most popular mobile payment activities among Generation X are making purchases (47 percent), paying bills (38 percent), and sending/receiving money (20 percent) — again trailing only millennials in each category.

Generation X leads all other generations, including millennials, when it comes to making payments via text message (17 percent).

According to Pew research, Generation X is incentivized to use mobile payments to:

- Receive rewards or discounts (62 percent)

- Avoid overdraft or check cashing fees (52 percent)

- Receive electronic alerts or receipts (52 percent)

- Budget or control spending (45 percent)

The reasons Gen Xers don’t use mobile payment technology can be just as informative to your outreach and billing strategy as their incentives. Seventy percent cite security concerns as their biggest barrier to using mobile payments, while 46 percent prefer to use cash (trailing only the silent generation born between 1925 and 1945).

Prepare Patients for All Expenses

Transparency can be a significant issue for patients, especially when it comes to costs. Confusing medical bills can leave patients unsure of their out-of-pocket expenses and surprised by their ultimate payment responsibilities.

A 2018 survey revealed that 54 percent of Americans had received a medical bill in the past year that they thought was covered by insurance. Another 53 percent reported receiving a bill that was higher than expected.

Patients deserve payment communications that clearly outline their financial responsibilities, including accurate pre-service cost estimation that breaks down insurance coverage and out-of-pocket expenses. The more transparent you can be with your patients’ financial obligations throughout their healthcare journey, the better they can prepare to make good on their payments.

RevSpring Can Help

Integrated payment communication is part of RevSpring’s DNA. We tailor the payment conversation to influence behavior and inspire action. Our segmentation rules and workflows help you become hyper-focused on the patient, understanding their ability to pay and mapping their financial obligations to repayment pathways.

If you’d like to learn more about our comprehensive patient engagement and billing solutions, we’d love to help you. Request a demo to see how we can help your organization meet its goals.