April 5, 2018

Nonelderly Uninsured — Healthcare Gaps, Affordability and Debt

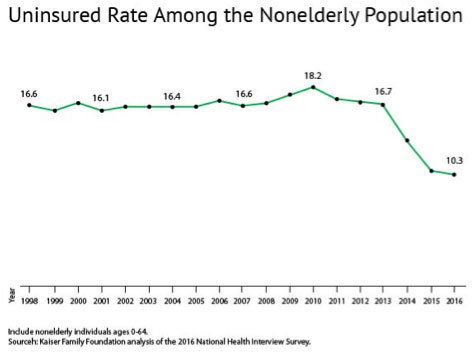

Since 2010, healthcare reform programs have made significant strides in reducing the number of uninsured nonelderly Americans. This population decreased from 44 million in 2013 to 27.5 million at the end of 2016. According to data from the Centers for Disease Control and Prevention, the uninsured rate among the nonelderly population fell to 10.3 percent in the same period — the lowest share since the agency began tracking 45 years ago.

Who Are the Uninsured?

This demographic of Americans includes those between the ages of 0 and 64 who do not have insurance coverage through their employer or through other public or non-group insurance plans. The population is largely the uninsured poor who are not eligible for financial assistance programs and cannot afford to purchase insurance.

Source: Kaiser Family Foundation, November 2017

The Uninsured and a Growing Affordability Gap

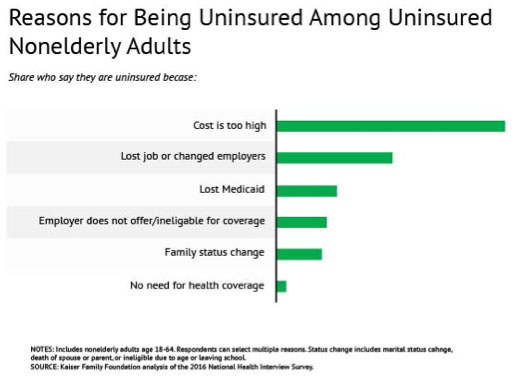

In 2016, 45 percent of uninsured adults said they remained uninsured because the cost of coverage was too high.

High cost ranks number one and nearly outpaces the next three reasons for being uninsured combined:

Source: Kaiser Family Foundation

Addressing Cost and Affordability Among the Nonelderly Uninsured

“Before the Affordable Care Act, most of the uninsured were low-income and either couldn’t afford coverage or didn’t have access to it,” notes Rachel Garfield, associate director for the Kaiser Family Foundation’s Program on Medicaid and the Uninsured.

Health reform provides subsidies for uninsured Americans to buy policies on the individual exchanges or expands access to Medicaid in the states expanding the program. Insurance reform also allows many young adults to stay on their parents’ plans until age 26, further reducing the number of uninsured.

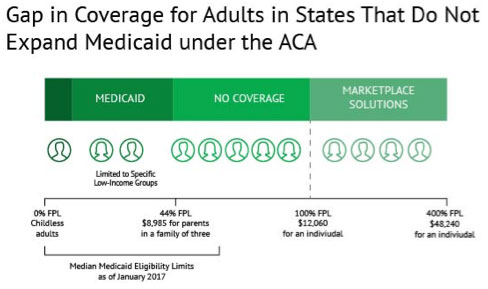

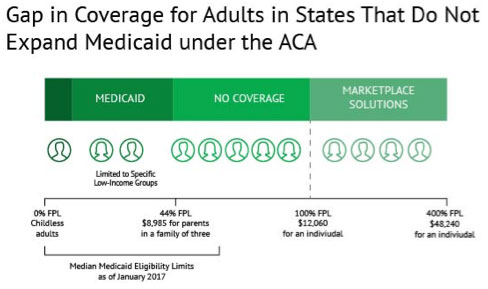

Medicaid Expansion and Gap Coverage

When income is above current Medicaid eligibility but below the lower limit for Marketplace insurance premium tax credits, a coverage “gap” forms.

The expansion of Medicaid coverage in 31 states helps close this insurance affordability gap for the nation’s poorest population. In states that chose not to expand coverage, nearly 2.5 million poor adults were left uninsured.

Source: Kaiser Family Foundation, November 1, 2017

Insurance Coverage Impacts Access to Healthcare, Continuity of Care and Debt

Health insurance coverage ultimately impacts a population’s health and its debt. Insurance status makes a difference in whether and when people seek medical care. Those who cannot afford care, or who delay care due to cost concerns, can launch a course of cascading events resulting in declining health, higher care bills and greater healthcare debt.

In our continuing blog series focused on the uninsured nonelderly population, we next examine medical debt shouldered by the uninsured and the healthcare organizations providing care. Our next post, “Three Ways to Help Uninsured Nonelderly Patients Close Healthcare Payment Gaps,” explores tailored patient education, communication and payment options that help uninsured patients avoid medical debt.

RevSpring Can Help

Integrated payment communication is part of RevSpring’s DNA. We tailor the payment conversation to influence behavior and inspire action. Our segmentation rules and workflows help you become hyper-focused on the patient, understanding their ability to pay and mapping their financial obligations to repayment pathways.

If you’d like to learn more about our comprehensive patient engagement and billing solutions, we’d love to help you. Request a demo to see how we can help your organization meet its goals.