March 22, 2019

HDHPs — Three Ways to Improve Payment Collection

This discussion is part of a two-part series focused on care affordability and high-deductible health plans. For more information on the rise of HDHPs and how they impact uncollected revenue, read “Care Affordability — How HDHPs Are Reshaping Payment Collection.” This post defines HDHPs and explores their market growth and impact on payment collection in the U.S.

Healthcare insurance models have shifted along with payer financial risk and patient affordability, both impacting provider revenue realization. As consumer responsibility for care costs increases, provider organizations must adapt to a changing billing and collection model.

Collections on HDHPs (High Deductible Health Plans) are significantly lower than collections on low-deductible plans, but patients with low-deductible plans are a vanishing component of the provider’s managed care portfolio. Care delivery organizations are being forced to re-evaluate revenue recognition models, as collection on a larger percentage of their managed care contract portfolios draw from patients covered by HDHPs.

Self-pay balances once accounted for less than 10 percent of a provider’s total AR. Today, self-pay and HDHP patients can comprise nearly 40 percent of a provider organization’s portfolio — and that number is rapidly rising.

The Changing Definitions of Self-Pay and Uninsured

Uninsured Americans are the traditional self-pay demographic. Collection from patients without insurance averages 6 percent on the dollar. HDHPs are reshaping the definition of self-pay, creating a new category called “self-pay after insurance.”

This growing self-pay component of managed care contracts impacts provider revenue realization much like true self-pay consumers. Unpaid out-of-pocket care costs are forcing providers to make patients with HDHPs an engagement and communication priority.

Propensity (Not) to Pay

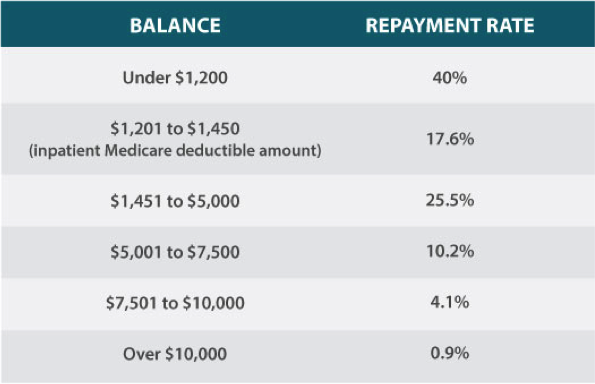

According to Crowe Horwath, self-pay after insurance balances under $1,200 yield a repayment of about 40 percent, with patients sometimes paying in full or establishing a repayment plan. As balances rise, payment drops, and HDHP patients with balances over $5,000 become nearly uncollectable.

Data Source: Crowe Horwath, 2017

Re-evaluate Your Approach to Financial Obligation Communication

The rise of HDHPs, self-payment populations, and very real revenue realization challenges are forcing providers to change their approaches to payment collection. Here are three steps healthcare delivery organizations can take today to impact self-pay and self-pay after insurance collection.

- Keep Payments on Course With Tailored, Positive Communication

Optimize payments with proactive, tailored patient communication and engagement solutions that target every stage of service delivery. Patient services may require specialized workflows that bring the financial conversation to the front door of care delivery and include a broader community of engagement.

A comprehensive patient communication solution helps healthcare organizations provide valuable financial information before service delivery. According to Accenture, patients say that communication is a payment workflow must-have. Nearly half of surveyed patients said they would switch healthcare providers for the ability to understand cost upon scheduling a service appointment.

Self-pay and self-pay after insurance patients value a clear, pre-service walk-through of charges, payment plans, and services available. These conversations pay revenue dividends post-service.

- Strive for Payment Solutions That Are Financially Realistic for Your Customers

Advanced business intelligence and segmentation capabilities allow provider organizations to confidently deliver the right message and the most convenient payment paths based on their patients’ behavioral patterns, preferences, and predicted outcomes. This level of tailored engagement promotes upfront payment awareness, increased response to collection efforts, and a positive patient billing experience.

Intelligent segmentation also helps you to understand where patients stand in their current commitments and to tailor future care delivery conversations in a compassionate and understanding way. Demonstrate compassion, empathy, and understanding from the front desk to the back office with patient-first communication, education, and billing solutions that match your customers’ willingness and ability to pay.

- Create Workflows That Work for Your Patients

Bring each patient’s unique payment demographics into view. Identify patients with low propensity-to-pay scores, and channel conversations and outreach toward payment plans. Successful revenue cycle solutions go beyond the default one-size-fits-all view.

Adopt revenue cycle management solutions that inspire patients to take the next step toward payment, whether it’s an application for a charity program or scheduling a payment plan. Intelligent outreach solutions help you create business rules shaped by data in your statement files to tailor each patient engagement.

RevSpring Can Help

Integrated payment communication is part of RevSpring’s DNA. We tailor the payment conversation to influence behavior and inspire action. Our segmentation rules and workflows help you become hyper-focused on the patient, understanding the patient’s ability to pay and mapping his or her financial obligations to repayment pathways.

If you’d like to learn more about our comprehensive patient engagement and billing solutions, we’d love to help you. Request a demo to see how we can help your organization meet its goals.