September 24, 2018

Beat the Reconciliation Blues with Merchant Services

The time you spend reconciling reports each day probably feels like a natural part of your schedule — it’s so natural that you likely don’t think about the lost time, delayed cash, and reporting inaccuracies that are a drain on both your team and your results.

In their white paper, Revenue Cycle Management – A Life Cycle Approach for Performance Measurement and System Justification, HIMSS explained not just the complexity of the payer reconciliation process but the steps “high-performing organizations” should be taking to refine them.

“Effectively managing the high volume of incoming claim responses from payers has long been a labor-intensive, thankless function performed by the business office. Technology, however, has progressed considerably since the beginning of the 2000s. Today, large fractions of previously manual-entry work has been automating in downstream departments. High-performing organizations are scrutinizing workflows and further enhancing the effectiveness of these departments.”

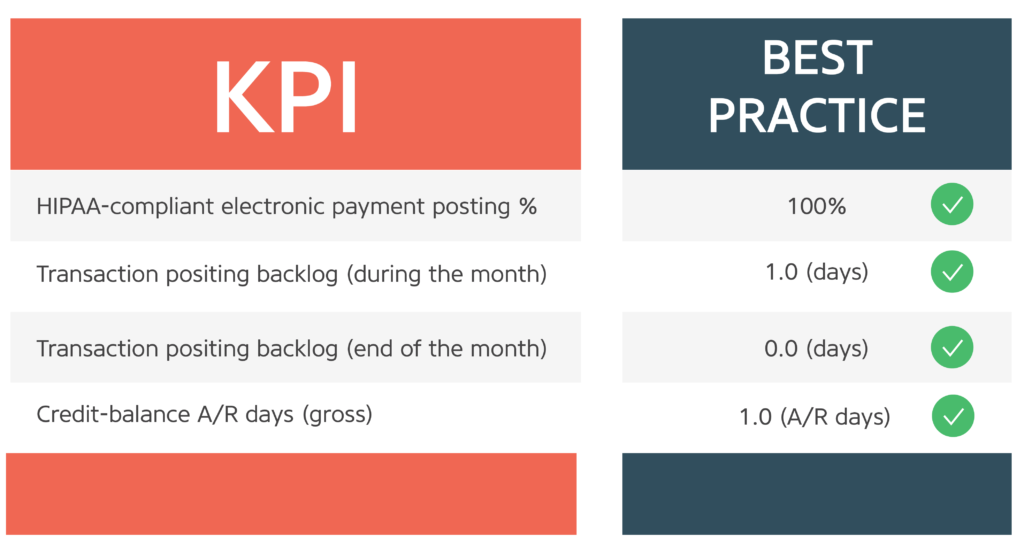

Remember that these days, patients are payers too, meaning HIMSS standards can be a strong starting point in your journey to becoming a “high-performing organization.” HIMSS goes even deeper and suggested tracking specific KPIs and maintaining best practice standards specifically for cashiering, refunds, and adjustment posting.

If your patient payment KPIs are missing the mark, it’s time to consider a new approach to your reconciliation processes.

Merchant Services is Changing the Reconciliation Game

Merchant services offers multiple benefits including increasing payments and allowing your patients to pay the way they feel most comfortable. That’s just the patient-facing side.

On the back end, merchant services provides a host of benefits to hospital business offices — benefits that are needed more than ever in today’s complex payment environment.

For example, bill-to-payment reconciliation shaves off the multiple hours you average each day matching transactions posted to your RevSpring reporting. It works by taking each transaction processed in your merchant account and then bumping it against overall cash deposited in your bank. When you streamline your merchant services and other payment solutions with us under one vendor, we can handle the processing results and reconcile the payments and bank deposits for you.

The result is a mix of reports that provide you with transparency and peace of mind across the board:

– Detailed reconciliation reports that break down payments already processed, payments pending processing, and existing and future bank deposits

– Month-end reports that outline which payments were processed that month and which will carry over to the next

– Patient accounting system upload files that can be synchronized with bank deposits, enabling timely uploads to your accounting system

Passing your reconciliation woes off to RevSpring allows you to reap all the benefits that modern payment automation provides — broadening the scope of your reconciliation to include card authorizations and settlement results, as well as card acceptance and bank deposits. Consolidating merchant services under one vendor brings you the accuracy, transparency, and efficiency that’s so important to today’s stretched hospital budgets.

RevSpring Can Help

Manually reconciling payment data can cost hospitals thousands of dollars in labor costs each month. We’ve taken a manual, labor-intensive, error-prone process and have automated it in the Cloud to intelligently match payment data from the payer with the amounts and information in your billing records to confirm payments are accurate and notify you of any outstanding charges. We can automatically reconcile almost all of your payments, leaving you with more time to manage business-critical initiatives.

If you’d like to learn more about our comprehensive patient engagement and billing solutions, we’d love to help you. Request a demo to see how we can help your organization meet its goals.