December 4, 2018

4 Signs Your Hospital Should Consider Merchant Services

At this very moment, a doctor somewhere (maybe even in your building) is lecturing a patient about ignoring obvious signs of health issues.

The patient was experiencing pain, shortness of breath, trouble focusing, or a host of other issues, but they kept pushing forward as if things would get better on their own. If only they’d acted earlier, treatment would have been faster, more effective, less painful, and even less expensive.

Something very similar is likely going on with your revenue cycle.

Major changes in the healthcare landscape have turned yesterday’s standard processes into liabilities — and there’s a good chance you’re receiving regular warnings that you need to take action.

One of the most effective responses to today’s revenue cycle challenges is merchant services, and there are a few specific signs that your organization would benefit from this technology-enabled approach to payment processing.

1. Your Cash Posting is a Problem

Healthcare payments are amazingly complex, and with a rise in patient financial responsibility, that’s only becoming more apparent. Your patients are making payments at different stages of treatment, accounts are being settled by multiple plans, and in some cases, third-party payers add an extra level of complication, especially with cash posting.

If you’re seeing issues with unposted or mis-posted cash, errors from multiple inputs, or declining cash poster efficiency, it’s time to consider merchant services.

Not only does a merchant services approach automate a large number of your cash posting and reconciliation functions, it also frees up dozens of hours per cash poster each week and encourages team resilience, allowing your entire organization to better respond to new revenue cycle challenges.

2. Bad Debt is Growing

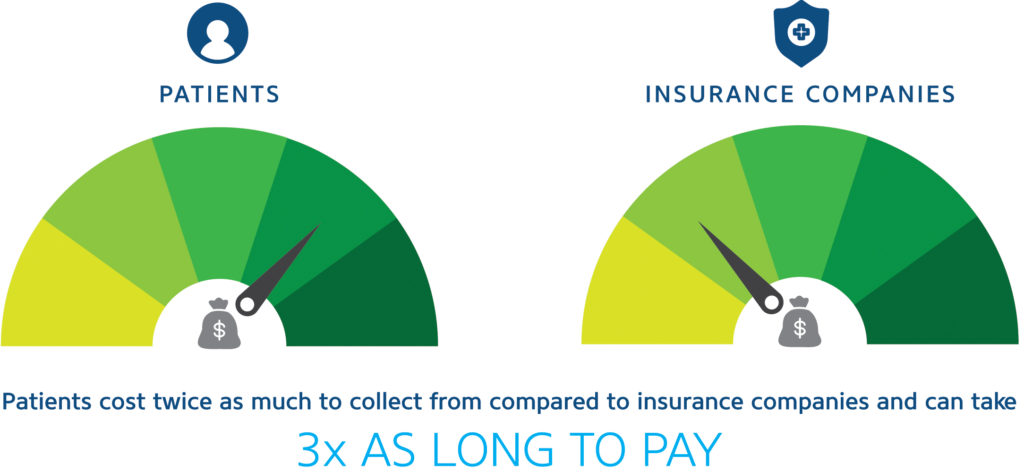

If bad debt is growing at your organization, you’re not alone. Patients represent a top-tier payer for many organizations, which can be a nightmare for your collections rates.

Patients cost twice as much to collect from compared to insurance companies and can take three times as long to pay. This increases your administrative burden, but it also means you’re likely collecting a lower proportion of revenue overall.

If you see your bad debt numbers swelling, merchant services should be on your short list of technology considerations. Not only does it ease administrative burdens, but it also gives patients more options in settling their bills.

3. You Care About Patient Satisfaction

Now that patients are a top-tier payer, their satisfaction matters more than ever.

Patient satisfaction is a multi-faceted concept that is impacted by everything from clinical experiences to the design of your facility. One of the most fundamental contributors to satisfaction is the patient financial experience. If your satisfaction numbers are dropping, there’s good news! You have an emerging opportunity in the form of merchant services.

Your patients are used to flexibility and consumer-centered experiences in retail, banking, and dining and they expect the same when it comes to healthcare. These other industries make heavy use of merchant services to keep their consumers happy, so if you’d like to catch up and score simple patient experience points, an integrated merchant services solution might just be your answer to driving optimal patient satisfaction outcomes.

4. Your Patient Mix Skews Older (or Wealthier)

One of the clearest signs that you should consider a merchant services solution is also one of the subtlest, and that’s your patient demographics.

Preferred payment method varies across a number of factors, but age and income are two of the most prominent. For example, did you know that according to CreditCards.com, debit cards are preferred by people with incomes up to $50,000, and credit are preferred by people making over $75,000?

You’ll see a similar dynamic regarding age. Younger people (who likely haven’t had a chance to establish credit) prefer paying via debit card, but credit starts to gain prominence around age 35 and is a clear winner among the 65+ Medicare crowd.

The lesson here is that in certain populations, you might need more flexible and reliable credit card options, so take a look at your patient demographics when you’re evaluating what merchant services can do for you.

Every day that passes is an opportunity to listen to the signs and learn more about the potential that a merchant services-enabled revenue cycle holds for your organization.

RevSpring Can Help

RevSpring is a leader in patient communication and payment systems that tailor engagement touch points to maximize revenue opportunities in acute and ambulatory settings. Since 1981, RevSpring has built the industry’s most comprehensive and impactful suite of patient engagement, communications and payment pathways backed by behavior analysis, propensity-to-pay scoring, intelligent design and user experience best practices.

If you’d like to learn more about our comprehensive patient engagement and billing solutions, we’d love to help you. Request a demo to see how we can help your organization meet its goals.