February 13, 2018

3 Ways to Create a Payment Workflow That Works for Your Patients

Consumers are demanding more for their healthcare dollar from provider organizations. In a shifting care delivery economy, one in which patients bear a growing responsibility for payment of services delivered, healthcare providers must be willing to create consumer engagement workflows that work for patients.

From communication strategies to bill payment workflows, improvements must meld customer service with consumer empowerment. This blog post reviews three patient engagement workflow changes provider organizations can make today to:

- Improve the payment conversation.

- Increase patient satisfaction.

- Close payment gaps.

Deliver 360ᵒ Patient Communication

From routine visits to chronic care appointments, acute and ambulatory provider organizations are rapidly shifting engagement workflows to focus on delivering a consumer-forward experience. According to James Green, a national partner with Advisory Board’s revenue cycle management division, patient outreach is stuck in a two-touch point approach to consumer communication:

- Registration on the front end of service delivery.

- Bill adjudication on the hospital or health system’s back end of billing.

Savvy care providers are shifting the conversation about care delivery and care payment by focusing on consistent, comprehensive and tailored engagement at multiple consumer touch points. From pre-visit appointment outreach and point-of-service cost estimation to post-service follow-up, providers are breaking down communication and payment barriers.

Here are three workflow changes you can put to work for your patients:

1) Tailor Billing Statements

Healthcare billing statements don’t have to be confusing, yet 3 in 4 consumers surveyed are confused by their bills from doctors, hospitals and other medical providers. According to Fiserv’s Eighth Annual Billing Household Survey Insights, consumers who receive upfront estimates of service billing are more likely to meet payment commitments, are more satisfied with the services delivered and are more loyal to service providers.

Successful revenue cycle solutions go beyond the default, one-size-fits-all view. RevSpring helps you:

- Create business rules driven by data in your statement files to tailor each patient engagement.

- Create workflows that bring each patient’s unique payment demographics into view.

- Identify patients with low propensity-to-pay scores and channel conversations and outreach toward payment plans.

- Bring together improved payment communication and multiple ways to pay to boost payment response.

We choose the color, layout, call to action, placement of text and the delivery channel that inspires a patient to take the next step. That step may include an application for a charity program or a payment plan.

2) Offer More Ways to Pay

Bring speed, security and patient satisfaction to your billing and collection processes. When it comes to electronic engagement, consumers have the world at their fingertips. From banking to dinner reservations, consumers expect real-time experiences. The same is true with medical bill payments.

Bring speed, security and patient satisfaction to your billing and collection processes. When it comes to electronic engagement, consumers have the world at their fingertips. From banking to dinner reservations, consumers expect real-time experiences. The same is true with medical bill payments.

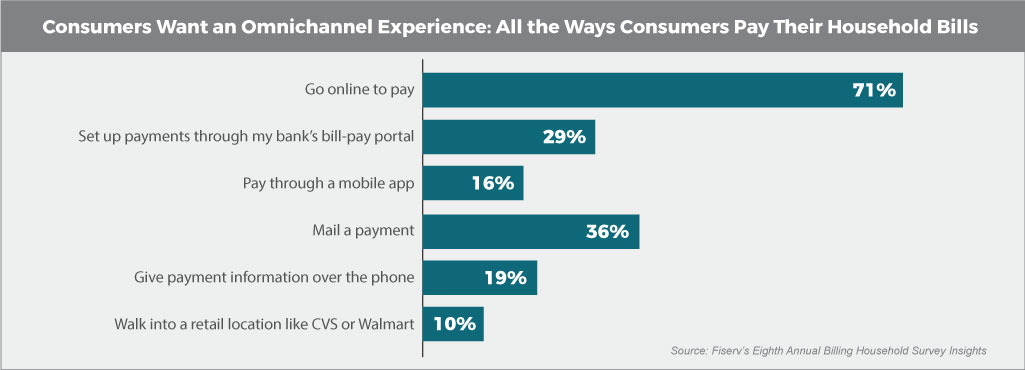

Advisory Board’s James Green recommends healthcare organizations implement a revenue cycle workflow that includes multiple ways for patients to pay their bills. Consumers want an omnichannel bill-paying experience, and patients are rapidly adopting online payment channels that accept payment cards.

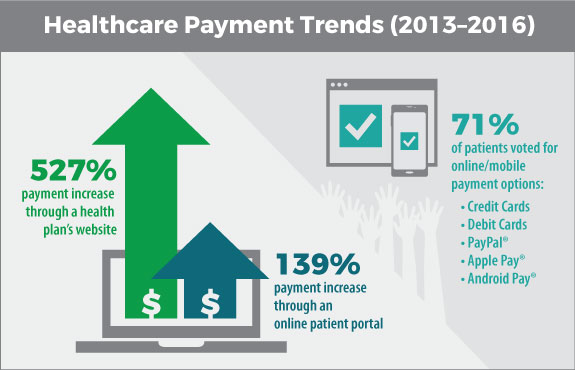

According to a report on healthcare payment trends, online and e-wallets are on the rise as preferred payment channels. Patients prefer omnichannel medical bill payment methods (58 percent voted for online options), and they prefer payment via credit and debit cards with a growing interest in mobile payment systems, also known as e-wallet systems, including PayPal®, Apple Pay® and Android Pay®.

3) Make 360ᵒ Communication a Core Competency

According to Forrester Research, organizations that put the consumer at the center of their processes, policies and practices will successfully develop and deliver the experiences that customers are ready to embrace — and that includes bill payment.

From the front desk to the back office, customers want consistent engagement experiences, including financial interactions. Blending consistent, high-quality care delivery with tailored engagement touch points is core to achieving optimal outcomes, patient satisfaction and improved payment responses.

Seventy-five percent of consumers expect consistent experiences across multiple channels (web, mobile, in-person, social). Look for cohesive solutions that put clear and consistent patient communication top-of-mind, from appointments to payments.

Impacting Your Bottom Line

Patients respond positively when they’re treated with respect. RevSpring makes the payment process clear to your patients at every engagement, so your team’s service and commitment are what leave a lasting impression.

If you’d like to learn more about our comprehensive patient engagement and billing solutions, we’d love to help you. We can share customer success stories and case studies, and give you the resources you need to choose the right solution for your organization. Request a demo to see how our comprehensive patient engagement and billing solutions can help your organization meet your goals, or connect with us on Twitter, LinkedIn, or Facebook to learn more.