April 12, 2018

Nonelderly Uninsured — 3 Ways to Help Patients Avoid Medical Debt

This discussion is part of a two-part series focused on the uninsured nonelderly population. For more information on the uninsured nonelderly demographic read “Nonelderly Uninsured — Healthcare Gaps, Affordability and Debt.” This post explores the impact insurance coverage status has on healthcare access, delivery and debt.

The nonelderly uninsured rate has decreased since 2010, but it remains a critical issue, driving higher out-of-pocket costs and medical debt.

Breaking Down Care Barriers

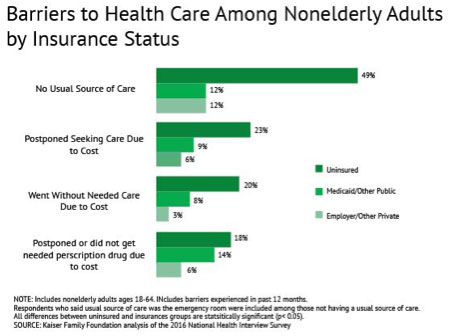

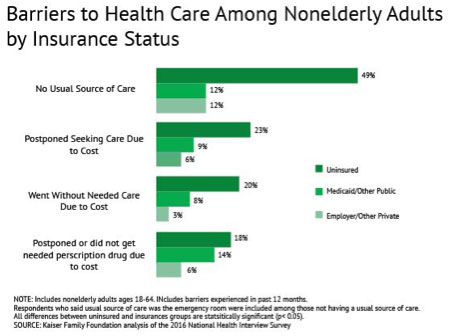

According to the Kaiser Family Foundation, one in five uninsured adults in 2016 went without needed medical care due to cost. Studies repeatedly demonstrate that the uninsured are less likely than those with insurance to receive preventive care and services for major health conditions and chronic diseases. Even gaps in coverage created by a change in employment status force patients to postpone medical treatment or stop taking prescription drugs due to affordability concerns.

The True Cost of Healthcare for the Uninsured

Treatable or preventable conditions become acute and costly when routine or ambulatory care is delayed. For those who cannot afford care, acute care services can even shift. Studies show that when the uninsured are hospitalized, they receive fewer diagnostic and therapeutic services and have higher mortality rates than those with insurance.

Source: Kaiser Family Foundation, November 2017

When the uninsured receive medical treatment, their anticipation of high medical bills and medical debt results in a lack of adherence to therapy instructions. Patients without insurance who are injured or diagnosed with a chronic condition are less likely to obtain all medical services recommended for treatment of their condition — including filling recommended prescriptions.

This cascading postponement of treatment results in higher treatment delivery costs and debt as chronic conditions become acute.

Three Ways to Combat Rising Medical Debt and Effectively Engage Uninsured Patients

Medical debt is the most common type of past-due bill or payment about which consumers are contacted. For consumers with past-due bills in collection tradelines, one in four has only medical bills that are past due, according to a 2017 study from the U.S. Consumer Protection Bureau. Half of those with only medical past-due bills would otherwise have clean credit reports.

Many patients have on-time payment track records, making them ideal candidates for payment plan education and early conversations about payment expectations. Here are three ways to leverage education, communication and tailored payment options to combat medical debt.

1) Reshape Patient Education

Improve end-to-end communication with patients, their extended care team and family members to meet individual needs. Demonstrate compassion, empathy and understanding from the front desk to the back office with patient-first communication, education and billing solutions.

Patients respond positively when they’re treated with respect, and for many patients, the fear of medical debt freezes positive healthcare action.

Make financial obligation and payment education conversations part of your engagement workflow. Clarify the payment process with patients at every engagement. Offer billing education that reflects your willingness to partner with your uninsured patient population, building a rapport so that your service and commitment are what leave a lasting impression.

2) Tailor Communication

Breaking down patient communication barriers is critical to promoting trust and building an effective healthcare partnership. Strong care delivery partnerships decrease billing and medical debt anxiety and increase a patient’s commitment to their own healthcare. This commitment improves adherence to medical service recommendations, positively impacting health outcomes and reducing medical debt.

Advanced technology and patient data intelligence help healthcare organizations deliver tailored communications and payment options throughout the patient journey. Advanced billing and collection portals easily augment current patient engagement solutions to highlight those candidates who may qualify for a charity program or other supplemental or enhanced payment support.

Technology solutions bring speed, security and increased patient adherence to patient engagement, billing and collection workflows.

3) Highlight Payment Options

The link between payment options, patient engagement and patient satisfaction is trending up — largely based on the growth of technology adoption.

There is a correlation between patient demographics, preferred channels of communication and payment workflows. Tailoring outreach channels, messages and payment options to patient preferences and abilities not only boosts payments received, but may also increase overall patient satisfaction.

Over 70 percent of consumers say they are more satisfied with service delivery when they are offered multiple paths to payment. When payment pathways align with a patient’s circumstances and ability to pay, revenue increases and bad debt decreases.

RevSpring Can Help

Integrated payment communication is part of RevSpring’s DNA. We tailor the payment conversation to influence behavior and inspire action. Our segmentation rules and workflows help you become hyper-focused on the patient, understanding their ability to pay and mapping their financial obligations to repayment pathways.

If you’d like to learn more about our comprehensive patient engagement and billing solutions, we’d love to help you. Request a demo to see how we can help your organization meet its goals.